Supply and demand for real estate services

This post aims to put on the table and combine a series of data to show that there is not enough demand for real estate services to sustain the existing supply of agencies or agents.

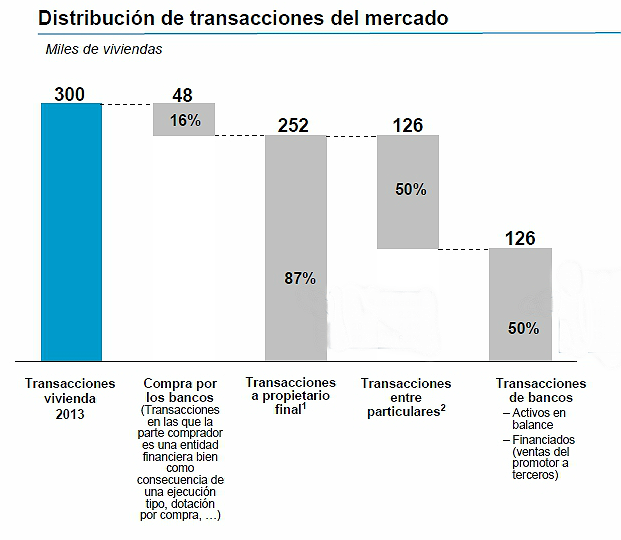

I have taken information from 2013 because it is the last one with data in the INE and with information contrasted in other resources. Since it is a question of having an order of magnitude that evidences a reality, I thought it reasonable to assume that the increase in sales in 2014 and 2015 has also been accompanied by a growing number of estate agents, and that in essence the scenario is the same. Please take a closer look at the table below, which was published a year ago on Idealist:

It is a study of Solvia which identified who and how the 300,349 housing transactions occurred in 2013.

I would like you to keep the three columns on the right and to join me in this reasoning: If we assume that of the 126,000 homes sold between private individuals, 25% (1) of them were FSBO operations (without agents), and that of the 126,000 sold by the banks, 75% (2) were sold by authorised real estate agents, then the total number of homes sold by estate agents in Spain in 2013 was 189,000.

Well, now the question is: "... But how many real estate agents were there in Spain to sell these homes?" And the answer is in the CNAE (National Classification of Economic Activities) codes 6831 (real estate agents) and 6832 (real estate property managers and administrators) and in the INE's statistical databases, which show us that 70,713 people were employed in these economic activities in Spain in 2013. and which in one way or another are integrated in the 32,000 real estate companies (agencies) registered in that year.

If we do the numbers and divide 189,000 operations by the 70,713 people - those registered - employed in the real estate brokerage and management sector we will get (don't cry) a ratio of 2.67 dwellings sold per person per year.

Is this too much or too little? Well, let's see: If the average price of housing in Spain in 2013 was around 1,700€/m2, we calculate an average surface area of 80m2 and an intermediation fee of 3.5% (3), then the total amount of invoiced fees charged per person employed in the sector for the whole of 2013 was 12,709€.. In other words, very, very little.

And now deduct social security and/or self-employed, rents, supplies, office material, cost of real estate portals, amortisation of equipment... And finally bear in mind that strictly speaking Pareto Principle there is a high probability that the 20% of the agents - among them those of Monapart- is closing the 80% of operations.

Does anyone still believe that this sector does not need regulation?

NOTES:

1. This 25% is an assumption based on the study carried out for the UCI by the consultancy firm GFK in which it is stated that 25% of the population would not rely on the services of an estate agent.

2. This 75% is based on the assumption that a part of the housing sales generated by the banks is done by own staff (own office managers or own sales team) and that those sales transactions carried out by authorised agents are remunerated at fees lower than 3%. I consider this to be a conservative estimate.

3. Assuming that the majority of the territory works with fees between 3% and 4%.

Is there enough demand for real estate services to sustain the existing supply of agencies or agents? In this post we answer this question with data extracted from the sector.