Why is the gap between landlords and tenants in Spain widening?

We analyse the history and current situation of the market to understand the reasons for the increase in homeownership in our country and the impact on the rental sector.

According to The Continuous Household Surveypublished by the INE, the gap between the number of homeowners and those living in rented homes is widening. The number of homes with mortgages is rising. If you are looking for sell your flat or property, this may be a good time.

Specialists are cautious. They want to know whether the surge is the result of a post-pandemic effect or whether, in reality, it is the Spanish cultural identity that is prone to purchase and ownership that is bidding to be maintained.

Why there is an increase in the volume of purchases and few rental properties

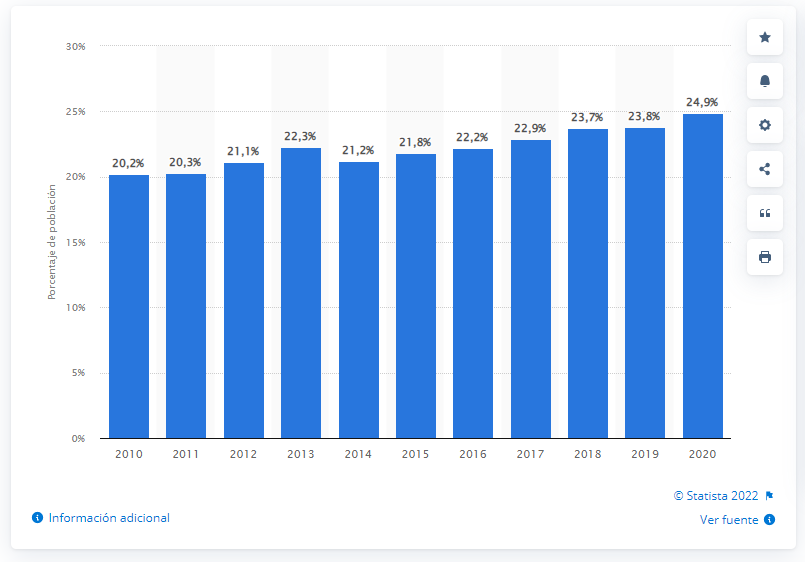

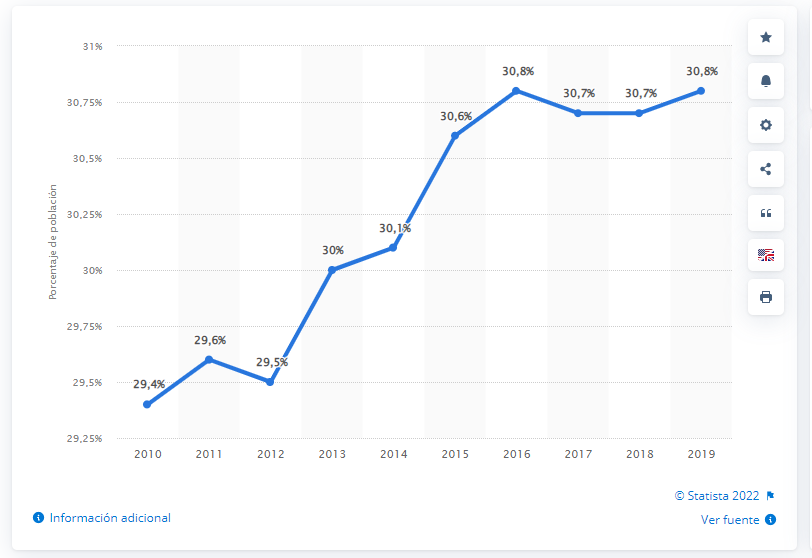

While it is undeniable that the percentage of rented housing has risen over the years, the number is still low compared to that of homeowners. In 2007, different surveys estimated that between 7% and 14% of Spaniards lived in rented flats. By 2018 the percentage had risen to 20%. Even Eurostat took that number up to 22%. However, these data do not come close to the European average of 20% or the almost 50% in Germany or Austria.

Percentage of rental housing in Spain

Percentage of rental housing in the EU

To what do we owe this difference? To a housing policy that the Spanish state has been implementing for decades: the social housing.

Unlike the social housingIn the case of Spain, which promotes access to public housing on a rental basis, Spain encourages access to housing through private ownership.

Map of public housing in Barcelona

Throughout history, housing production was boosted and home ownership was used as a means of access to housing.

A change of model

In 2013, (out of necessity) Spain made a U-turn in order to change its model and to opt for renting. Proof of this are the following three points:

1. The State Plan 2013-2016. The specific objective of which is to direct the state's housing policy towards the "promotion of rental housing, building renovation and urban regeneration and renewal". in lieu of construction to acquire ownership.

2. The new law 4/2013, regulating the rental market. It eliminates state intervention in this type of contract and favours the freedom of the parties when contracting.

In this regard, it is very interesting (in order to understand the reason for the change) to reread certain points of its Preamble:

The Spanish real estate market is characterised by a high ownership rate and a weak rental market (...)

At the time the law was passed, Spain was the European country with the highest rate of housing per 1,000 inhabitants and also one of the lowest in terms of rental housing stock.

In the current economic framework, The negative implications of this feature of the housing market for the Spanish economy and society are obvious and affect both the mobility of workers and the existence of a large number of empty and unused homes.

The reality, therefore, is that the rental market is not an effective alternative to the property market in Spain, since either the supply of rental housing is insufficient, or it is not competitive because it is subject to very high rents (...)

Hence, the search for mechanisms to make this market more flexible and dynamic must move within a framework that manages to attract the greatest possible number of dwellings, currently empty and without any use, in the hands of private owners.

3. The elimination of tax benefits for the purchase of housing. This deduction allowed taxpayers to deduct 15% of the costs of the purchase, construction, extension or refurbishment of the property from their personal income tax up to a maximum of 9,040 euros.

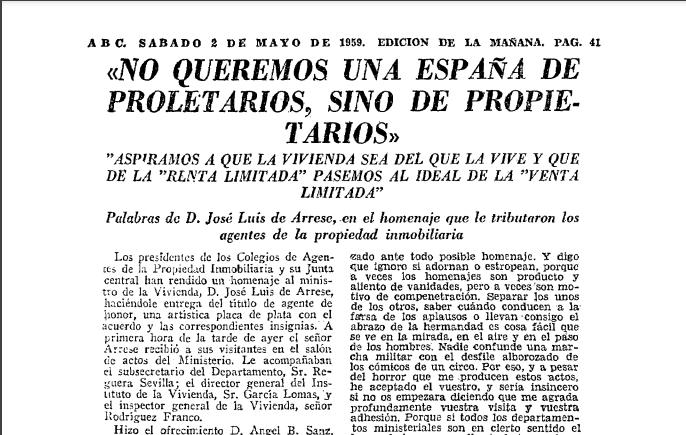

In 1959, the first Minister of Housing, José Luis de Arrese, stated: "We do not want a Spain of proletarians, but of owners".

Today, the focus of the state's housing policy is shifting to the promotion of renting and renovation.

In Spain there are 157,000 fewer households renting than a year ago and 170,000 more with a house of their own with outstanding payments. There are 14.5 million property owners against 3.2 million who live in rented accommodation. What is the reason for this phenomenon?

"Spain is a country of convinced landlords and forced tenants".

Sandra López Letón puts it clearly. In her article "Spain, a country of repeat offenders". for El País, he breaks down the Spanish ideal and its relationship with real estate, and provides us with the following data for analysis:

→ House purchases have left behind the effects of covid and are now at levels of 13 years ago.

→ In August, 49,884 transactions were closed, a figure not seen since April 2008.

→ "Buy-to-let is driving the recovery of the housing market".

→ Housing has become a safe-haven asset in the face of the inflation (up by 5.51 p.p.3 in October)..

→ The purpose of these purchases is both replacement - moving to a better home - and investment. Because, says Higueras, "accumulating wealth is a national sport, we have been taught it, it is in our DNA". Almost 90% of people over 65 own a home in Spain.

It would seem that the impulse to buy, nowadays, is a mixture of idiosyncrasy, doing business with savings and investment, and not so much a need for access to housing. To reinforce this argument, the author quotes Cristina Arias, Director of the Tinsa Research Department, who explains the increase in purchases with three specific pieces of information:

"Consumer confidence, followed by an improving property market outlook after months of increased household savings and, to a lesser extent, the incentive of low interest rates".

What is the biggest problem with renting in Spain?

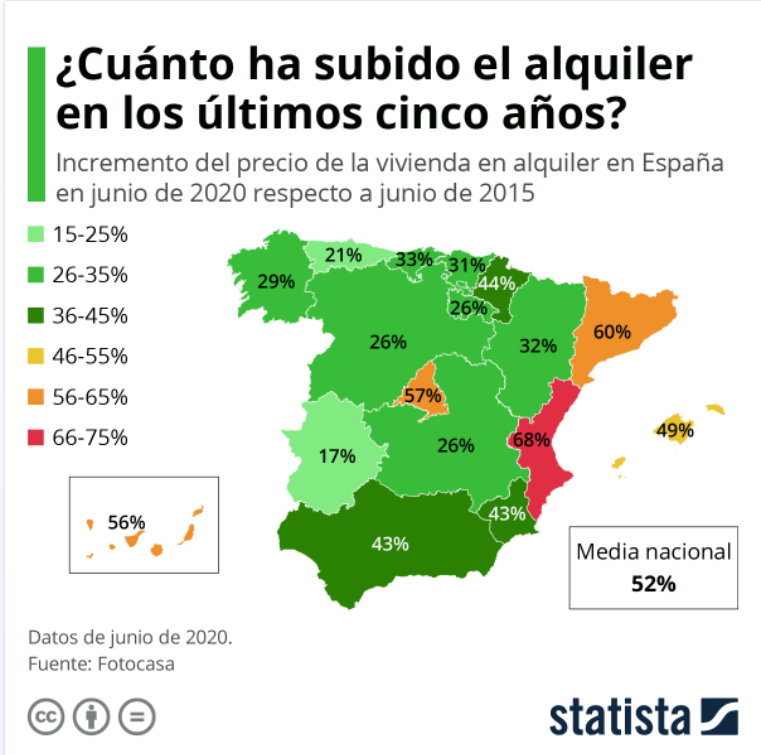

There are basically two: There is little rental housing and the price is very high. Although it does not affect the whole territory, it does have an impact on the most important populations.

This has a major impact on the finances of the most vulnerable, on the emancipation rate of young people, on fertility rates and even on how innovative cities are.

In this context, at the beginning of February last year, the State Housing Rights Act where the government regulates the market through:

- Public rents in new housing developments

- Tax benefits for small landlords to lower rental prices

- More taxes for empty homes

- Limiting renting to large owner-occupied dwellings

- Regulation of evictions

- Definition of stressed market area

- Creation of incentivised affordable housing

- Creation of a social housing fund

- Impossibility to change public housing status

Regardless of the positions for and against the new law, we continue to work to make our Monaparters community happy. If you are looking for sell o rent a property, whatever your motivation, get in touch with us. As you can see, we know what we're talking about, and we want to help you!