Taxes on the sale of a flat: how much do I have to pay?

If you are about to sell your home, take note: in this post we tell you everything that the Tax Authorities require from you in terms of taxation on the sale of your home.

In all cases where the sale of a flat If there is a profit for the seller, it will be necessary to settle with the tax authorities in order to pay the seller's taxes. It is important to know what taxes are associated with the sale and how much time we have to pay them.

How much do I have to pay to the tax authorities on the sale of a property?

The Tax Agencyin collaboration with the Instituto de Estudios Fiscales, created an entertaining didactic guide in which it states, in a cross-cutting manner, that "Throughout history, money has always been needed to pay for the expenses of the state and that is why taxes were created".

A clear statement of principle: to maintain the state, it is necessary to generate resources by collecting taxes. While the tax burden in Spain is one of the lowest in the eurozoneat the time of payment taxes on the sale of a flat this rule does not hold so firmly.

According to Ignacio Faes of elEconomista.comWhen it comes to paying taxes on the sale of a flat, Spain is one of the places with the highest tax burden in Europe. The specialist states that "Last year's tax reforms have pushed Spain's tax system down another three places in the property tax ranking of the Tax Foundation's International Tax Competitiveness Index 2021".

Translated: he is telling us that Compared to the other OECD countries, Spain is one of the most heavily taxed countries in this area.. The general principle is that if the sale generates a profit, the seller must pay tax to the tax authorities.

How much do we have to pay to the tax authorities in particular? The final figure will result from a series of calculations in relation to three specific taxes which will be discussed in the next section.

What taxes are payable by a Spanish taxpayer on the sale of a flat?

There are three taxes on the sale of a flat which are payable by anyone who carries out this type of transaction:

Personal income tax on the capital gain obtained

Personal income tax (IRPF) is the tax levied on the income that a taxpayer-individual resident in Spain earns during a whole year. It is calculated on the total of their earnings, income and attribution of income, as well as on their capital gains and losses..

Hence the acronym Itax on the RThe Persons Fs physical disabilities.

It is a progressive, personal and direct tax. This means that the more money a person generates, the higher the percentage to be paid will -correlatively- increase.

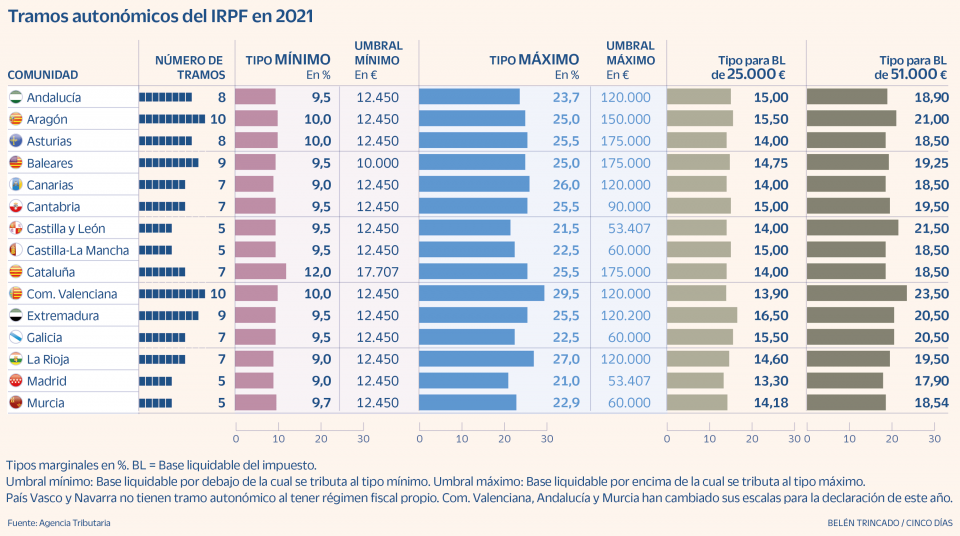

One of its peculiarities is that varies according to the autonomous community in which you live. For example, in Catalonia it consists of 7 brackets that increase progressively from 12% on the taxable base of €17,707 to 25.5% on the taxable base of €175,000.

Municipal Capital Gains Tax or Tax on the Increase in Value of Urban Lands

This is the tax levied on the increase in value of urban land at the time of sale. In most municipalities, it must be paid within 30 working days of the sale of the house. In the case of an inheritance received, the deadline is usually 6 months after the death of the deceased. The regulation of the percentages depends on each municipality.

Property tax (IBI)

Here what is taxed is the value of the property, but according to the cadastral classification: urban, rustic, special characteristics. This classification depends on the nature of the land.

The owner of the property is the taxpayer of this tax. It is payable on the first day of the tax period, which coincides with the calendar year, and is therefore due on 1 January of each year.

It is characterised by the fact that it is a local, compulsory, direct, real, objective and periodic tax.

How to calculate personal income tax on the sale of a property?

In order to calculate the IRPF for the sale of a property, we must first find out whether there is a profit on the real estate transaction. To do this, it is not enough to calculate the difference between the initial purchase value and the final sale value. There are other variables that have an influence and that must be taken into account to determine whether we gain or lose money on the transaction.

Specifically, we must follow the following steps to calculate the IRPF for the sale of a property:

- Defining the value of the real estate transferWhat does this mean? It is necessary to obtain the real result that the sale of a property generates for the seller. To do this, the sale price of the house or flat must be reduced by the expenses and taxes linked to this transfer (for example: the municipal capital gain, real estate commission expenses, mortgage expenses, etc.).

- Define the acquisition value of the property. Here we repeat the mathematical operation or calculation, but on the buyer's side. We also seek to adjust this number in order to know the real amount for which the property that was sold is acquired. To do this, what we do is to add all the expenses (notary fees, mortgage constitution, etc.) and taxes (VAT, IAJD, etc.) related to the purchase to the sale value of the property.

- Define the DIFFERENCE between the two points above.. It is quite simple: just take the transfer value and subtract the acquisition value. If the result is not a profit, there is no obligation to pay personal income tax on the sale of a property. On the other hand, if we obtain a positive result, we will have to apply the tax percentages set by the Inland Revenue.

How are the percentages applied? The tax authorities establish a table of percentages by income brackets:

- Profits up to 6,000 euros: 19%.

- 6,000 to 50,000 euros: 21%.

- Profits between 50,000 euros and 200,000 euros: 23%.

- Earnings of more than 200,000 euros: 26%.

These percentages are applied progressively. In other words, the higher the profit, the higher the tax rate. This is best explained with an example: if you make a profit of €93,000 on the sale of a property, the tax rate is calculated according to the brackets shown in the table.

- Over the first €6,000, 19% will be applied.

- From €6,001 to €50,000 in winnings, it will be a 21%.

- Finally, from €50,001 to the final €93,000, a 23% will apply.

Also, don't forget to take into account the exceptions:

- In the case of reinvestment, if you sell your main residence to buy another (main residence).

- If you are over 65 and sell your main residence.

- Or if, being over 65 years of age, you use the gain to take out a life annuity.

You know... when it comes to selling a flat or house, get your wallet ready. You will not only receive the profits from the operation, but also the pressure from the tax authorities to meet your tax obligations. If, in spite of everything, numbers are not your thing and doubts persist, do not hesitate to contact us. Monaparter, don't forget: the accounts, always clear!