The hire-purchase contract: characteristics and advantages

We tell you in detail what it is about and why rent to buy can be an excellent choice when selling or buying a property.

The contract of renting a flat with option to buy is the "odd one out" in the industry. A little known contract and one of those that are regarded with suspicion. One that in times of crisis has always re-emerged as a valid alternative due to its wide-ranging benefits.

What is a hire-purchase contract and why is it interesting to agree on this type of contract?

It's a hybrid, that's for starters. A bit of a weirdo, but useful in these times, because in such a difficult context for obtaining funding, it operates as an alternative route. In essence, The hire-purchase contract is a mixed contract, consisting of two well-known subcontracts: the rental contract and the sale-purchase contract.

It has two main features:

- It is a phased performance contract:In other words, at an initial stage, it will be executed as an ordinary rental contract. The landlord will have the right to live in the flat for a certain period of time and to pay the monthly rent, but at the end of the lease term, the tenant will have to decide whether or not to buy the flat. However, the price - which was fixed at the beginning of the contract - will be reduced, totally or partially, by the accumulated amount of those monthly payments.

- It is an atypical contract:It is not covered by a specific law, nor is it contained in the Civil Code, although it is accepted and recognised in the Mortgage Regulation and, in general terms, it is regulated by the Urban Leases Law (LAU). "a pre-contract". where one of the parties "grants the other the exclusive power to decide whether or not to conclude the main sales contract".What does this mean? It means that the parties have a certain freedom to agree on the clauses that make it up. I say "certain"The general principles of law must of course be followed, as well as the typical elements of a purchase and rental agreement. When entering into this type of agreement, we recommend that you seek specialist advice, as you may lose out when defining the legal and fiscal consequences in relation to the terms, the sale price, the premium or deposit and the guarantee.

So why take the risk?

Calm down Barak, read on... There are advantages and disadvantages, but you'll see, it's a very useful contract.

The European Journal of Management and Business Economics provided an insightful analysis of the issue, summarising the advantages and disadvantages of this type of agreement.

Summarising the above, we can say:

✅ Benefits the lessee-buyer. The latter secures the property, as he has exclusivity over the purchase for the duration of the contract. In addition, if he executes the purchase option, he keeps the price fixed when the agreement is made and avoids "losing the rents" which are deducted from the price.

❌ It disadvantages him in that if he does not make use of the purchase option, he "loses" the monthly instalments. The same applies to the option premium. This consists of a sum of money outside the deposit, which is given to the landlord at the beginning of the contract. It acts as a guarantee to the owner in case the purchase option is not exercised and fixes the exclusive right to purchase the property for the buyer.

✅ Benefits the landlord-owner. It guarantees the monthly income for itself. In addition, it has a good insurance against non-payment of the rent due to the high initial premium that is usually fixed and that remains in case the purchase option is not exercised.

The downside for him is that, by fixing the price, he may end up selling for less than market value. Moreover, by not being able to offer it to third parties - for the duration of the lease - he may lose buyers willing to pay more.

You see, in a context of uncertainty it brings stability and certainty. This is no small thing. Thanks to this, we began to notice what is known as:

The rise of renting to buy a home

The growth of this type of contract comes as no surprise, at least to those of us in the real estate business. Although rent-to-own is a type of contract that emerged in the 1930s, the real estate and financial crisis of 2008 boosted it and gave it a certain degree of popularity. momentum.

Today, there are several factors that are helping a new resurgence:

- The COVID-19 crisis caused such an impact on the sector that it forced its actors to come up with creative responses for those pursuing the dream of owning their own home. Thus, this type of agreement creates a form of indirect financing and makes it possible to postpone the moment of the purchase decision.

- Rising housing prices in relation to wages + difficulty in obtaining finance. According to a study by the Civismo FoundationThe median net wealth of the under-35s has fallen by 93.7% in Spain between 2005 and 2017, the report notes. "Before the 2008 crisis, when credit was easy, fast and unrestricted, many people got access to housing. Many young people entered the labour market and immediately took out a mortgage.That is not happening today, according to El Economista: "Covid closes the door to housing for young people".. The volatility of youth employment plus the current uncertainty conditions, generate a restrictive attitude in banks when granting loans and mortgages for housing.

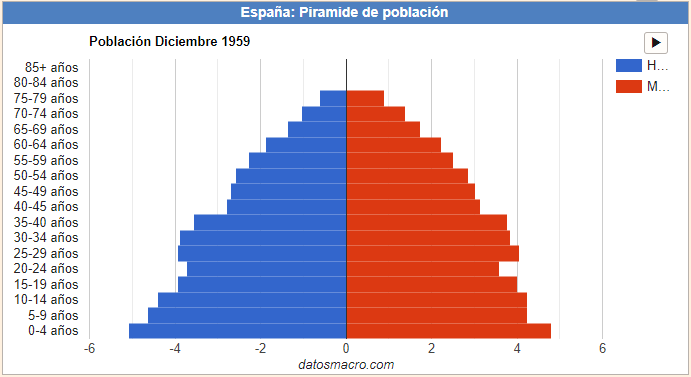

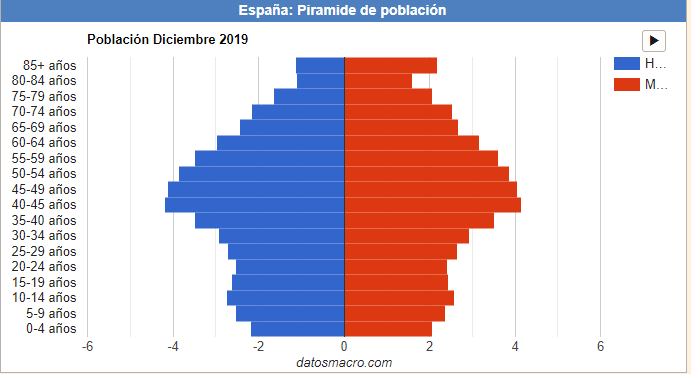

- The evolution of the population pyramid of Spain and the change of priorities. Today, millennials (those born between 1981 and 1996) occupy 24% of that pyramid.

A study conducted by Micappitala Spanish fintech company specialising in designing savings and investment plans, says that one in 10 investors' main goal is to buy a home. Today, the most common goal is much more discreet: to create a cushion for future contingencies.

A study conducted by Micappitala Spanish fintech company specialising in designing savings and investment plans, says that one in 10 investors' main goal is to buy a home. Today, the most common goal is much more discreet: to create a cushion for future contingencies.

Because of the context in which we live, because of the difficulty of earning a living and because of a question of generational priorities, new options are beginning to be considered.

The importance of the hire-purchase contract

In this context, leasing with an option to buy becomes interesting, as it allows the final decision to be postponed until later. This, as opposed to a purchase-sale where the decision is firm and irrevocable, seems to be an alternative that, as we said, provides a certain peace of mind in the face of so much uncertainty.

To validate our hypothesis we decided:

- Keeping an eye on the market. The fact that new players are emerging that focus their business model on this type of contract, gives us the indication that something serious is going on.

A clear example is Lucasa proptech Spanish real estate. They affirm (and confirm) what we have been saying:"The rapid rise in house prices and the tightening of lending criteria by banks are often the reason why young people cannot choose to try to get their first home.

- Check out what goes through the mind of a potential millennial renter-buyer.look:

Crystal clear...

Crisis: I don't get credit anywhere

▼

I am still not clear whether I should invest in property.

▼

But I'm sick of wasting my money on rent.

▼

What option do I have? Rent to buy?

▼

I can turn the monthly payment into an investment for my future home.

▼

Beautiful solution.

The guts of the contract: clauses in rent-to-own contracts

As I said above, it is not a standard contract. There is no section in the Civil Code called "rent to buy" that regulates its content.

The wording is then governed by the general rules of contracts (Articles 1254 to 1314 of the Civil Code), and by the rules of those contracts that resemble them, which are of the same or similar essential nature (Supreme Court Judgment 30.4.2002 -RJA 4038: rental and sale and purchase).

What must not be missing are the following two minimum conditions:

- The subject matter of the contract.

- The selling price.

Other relevant clauses in the hire-purchase contract are:

- The time at which the tenant can make use of the purchase option.

- The minimum instalments to be paid.

- The percentage to be deducted from the purchase.

- The possibility of extending the contract.

- What happens in case of late payment of the monthly payment.

- Exclusivity in the purchase by the tenant, for the duration of the contract.

- And so on... ad infinitum.

You see, the hire-purchase agreement is a useful but rather complex type of agreementwith many details to take into account. If you are thinking that this is a suitable option for your situation, do not hesitate to contact us, we will be happy to assist you! → info@monapart.com