Is it profitable to rent my holiday flat?

Airbnb seems like the new goose that lays the golden egg. Happy, dollar-driven hosts, cool and respectful tenants... or at least that's what we're told. But here it is. Monapart Madrid to dismantle (a little) the myth!

Within the huge community of owner-hosts on Airbnb and other similar platforms, there are three types of profile:

- People who rent out their usual residence during their holidays or a room during the year in exchange for a financial consideration.

- Investors with large volumes of housing.

- People who rent their second home. Those who plan to "I want to rent my holiday flat and get a juicy bonus"..

If you belong to the third group, ie, if you are a landlord who rents out your second home, this post is of interest to you..

Real estate tales and legends are full of wonderful stories about flats bought for "two quid", refurbished "for nothing and less" and rented out for Airbnb making a fortune. Let's say it's the new fairy tale from the creators of: "I flew to London for €1", "my children have always slept in one go" or the "I flew to London for €1".trending topic of the brother-in-law" in the Sunday stew (by the way, if you need the recipe to make croquettes with the leftovers of the stew, click on here).

The Madrid City Council has produced a very interesting report in which it makes a analysis of the impact of tourist accommodation in Madrid's Centro district from which we can draw conclusions that disprove that this rental option is the bargain everyone is talking about.

A Madrid City Council report focusing on the Centro district shows that renting a property through Airbnb is not that profitable.

The key to the profitability of temporary rental lies in occupancy.

Which is more profitable, tourist or permanent rental? Tourist rentals can provide owners with a much higher return than they could get from long-term rentals. According to data from Idealista, given the average rental price in the centre of Madrid, the rental of tourist accommodation would a priori be 46% more profitable than long-stay rentals.

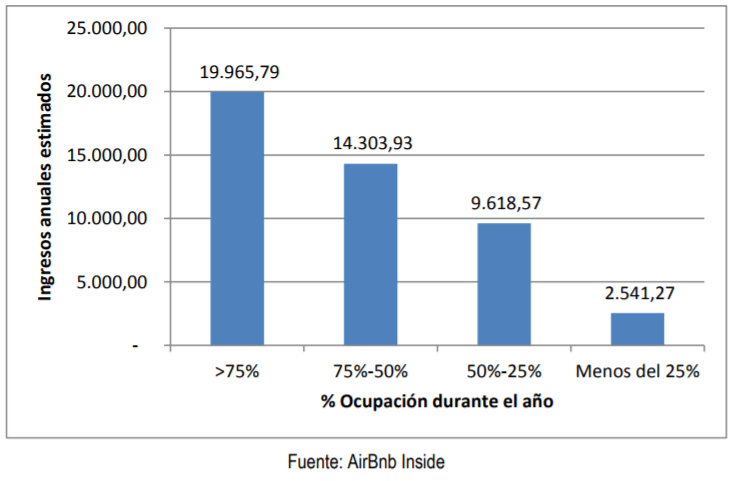

This graph shows the average income per tourist rental according to occupancy level based on data from Airbnb Inside and also published in the Madrid City Council report:

Therefore, in the light of these data, dwellings with an occupancy above 75% have an average profit of €20,000 per year, while those with an occupancy below 25% would have an income of €2,500 per year.

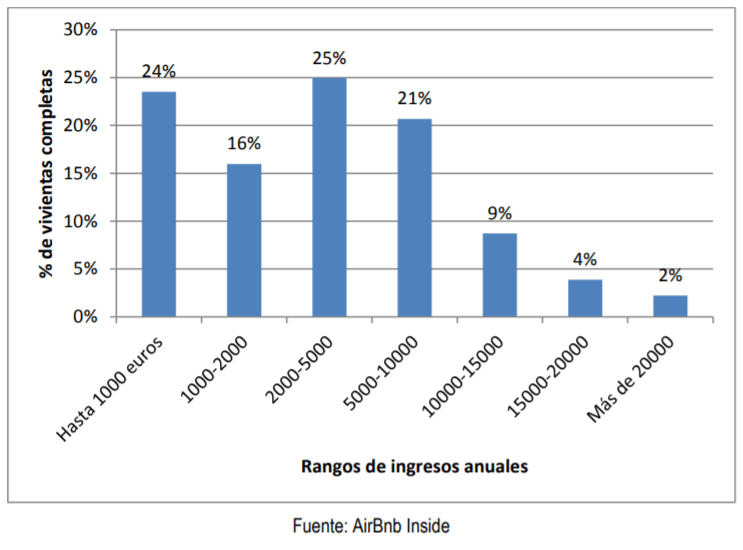

So, the next question is: How many hosts of a full house rented temporarily get more than 75% occupancy? Well again, according to Airbnb Inside data, not many. This graph shows the percentage of completed homes by annual income range.

In short, only 15% would have an annual income of more than €10,000 and only 2% (including your brother-in-law's friend) would have an annual income of more than €20,000.

Do they see you as a home sharer or as a receptionist?

Without wishing to dampen anyone's enthusiasm, you will agree with me that the initial spirit of sharing a house with a local to experience the city has gradually faded away. According to Airbnb, 95% of guests choose this form of travel because they want to experience the city as a local. However, in a study conducted by Exceltur in 2015, only 6.1% of those surveyed stated that this was their true motivation.

Increasingly, those who rent a property through platforms such as Airbnb, especially those who rent the entire flat, are looking for a professional service that is more in line with what they would expect to find in a hotel. And on platforms like these, where user reviews are so important, meeting these expectations requires investment and time.

How do I rent my holiday flat?

What expenses should you count on if you want to rent out your flat for tourism?

The self-sacrificing owner has read me, but says "It's fine, but I still want to rent out my holiday flat".. If you want your flat to be profitable and count yourself among the 2% lucky ones with an income of more than 20,000 € per year, you should know that:

- The decoration and maintenance of the house must always be impeccable.

- You should spend time on your ad, study the prices and its positioning on the platform.

- Cleanliness and details, such as offering breakfast for example, are particularly appreciated.

- You must be flexible and available to receive tenants.

- If you hire a company to do all these things, you should expect that they will take between 20 and 30% of the revenue + VAT.

- Take out good insurance for those "little things that break" that are not always covered by these platforms.

- Don't forget that Montoro has his eye on this type of income and that the tax authorities are "almost" all of us. This article explains what you will have to declare: Taxation of holiday home rentals.

I don't want to be a host any more, renting out my holiday flat is not my thing. What should I do: sell my house or rent it out?

Well, obviously it all depends on what you want, what you need and how profitable (financially and personally) the experience is proving to be for you. If you are considering the option of selling your property, I recommend that you look for a reliable real estate agent. who will advise you well, give you an accurate valuation of the price of your home in the current market conditions, inform you of the taxes you will have to pay, etc. Again, don't trust what your neighbour, your second cousin's daughter's boyfriend who "has studies" or what they say on TV tells you. In Madrid prices and sales have gone up but not in all districts equally.

This study of José Luis EcheverríaMonapart, founding partner of Monapart, published in the newspaper El Mundo, gives you the 10 keys to selling a house in 120 days.

The fear of renting your home for the long term

Again, there are many macabre stories here about bad and unpaid tenants. Of course there are, but the vast majority of us who live in rented accommodation pay religiously, take care of the flat and even improve it, and maintain a respectful and healthy relationship with the owner of the flat where we live. If you want to gain peace of mind, ainsuring your home against possible non-payment of rent is a very good option.

But as with the selection of personnel in a company, if you are concerned about your flat being well looked after, choosing the right tenant is crucial. To do this, it is important that you take the time to get to know them better and make sure that their financial profile, but above all their personal profile, is the right one for your home. Again, a good real estate agent will help you in this aspect, selecting from among all the candidates to rent your home, those who offer you the best and most guarantees. Think carefully about what kind of tenant profile you would like to have and in the end you may realise that you first need to renovate and adapt your home a little: How to refurbish a flat to rent it out.

In short, if you want a tenant who is like you, offer them a home where you would like to live. At Monapart we are specialists in selling and renting beautiful homes. If you are a host tired of being a cleaner, concierge, manager, public relations and handyman... it's time to meet us. Shall we talk?