Real estate investment: the basics

In Spain, unlike many European countries, the culture of home ownership is still alive and well. We discover the keys to making (and maintaining) a good property investment.

Although investment in housing does not require such in-depth knowledge as many of the financial products on the market, all investments require management, and the evolution of the value of the property will depend on how it is managed. There are many factors to take into account. Below we mention some of them and highlight the need to analyse the repercussions that the passage of time has on the property and how to make a good investment. asset management.

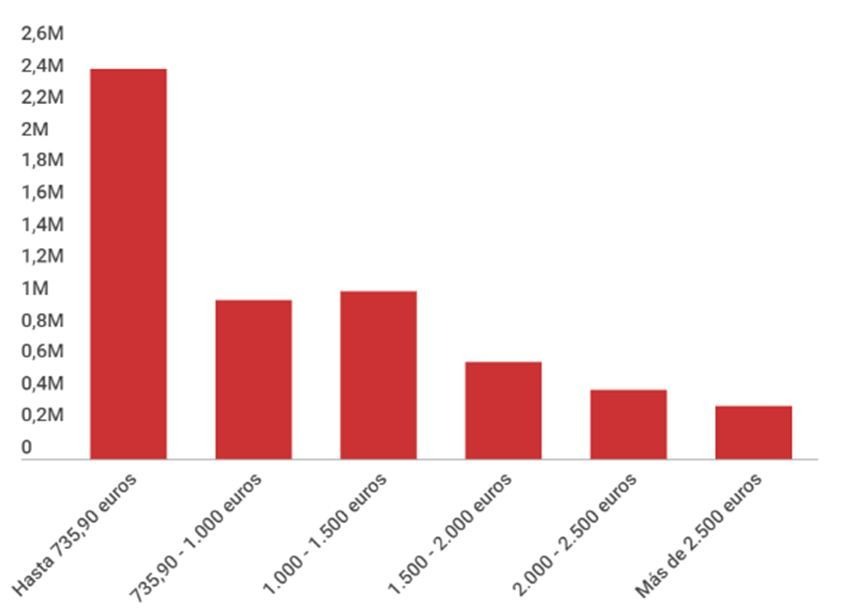

One in three pensioners earns below the poverty line, according to a report by the European Commission. GESTHA (Trade Union of Technicians of the Ministry of Finance) based on data from the "Statistics on the labour market and pensions in tax sources in 2016" prepared by the Tax Agency (AEAT).

Source: EuropaPress.es

It is clear that we are all concerned about retirement, even more so in these times when the revaluation of pensions in line with price increases and even the existence of resources to guarantee their payment in the years to come are being called into question. As it says Jesús Sánchez-QuiñonesGeneral Manager of Renta 4 Banco, "The purchasing power of pensions over the next twenty years is going to fall". Those who wish to maintain a certain standard of living in retirement must therefore be clear about the need to supplement their future pension - which is increasingly geared to basic sustenance - with other sources of income.

Generate savings and put them to work to grow. This is what any financial management manual recommends in order to build up a wealth that will guarantee a comfortable retirement. The question is: What should we invest in to achieve this goal?

There are a multitude of alternatives in the financial spectrum to achieve the longed-for miracle of "the multiplication of the loaves and fishes". The well-known deposits offer very limited returns and are designed more as short-term investment tools, so they are not the best option for the objective of ensuring a good retirement.

Other options include mutual funds, exchange-traded shares, ETFs, pension plans, index funds, etc. For most of them, a certain financial literacy is necessary to avoid shocks, either during the life of the investment or at the time of its recovery.

The purchase of real estate is one of the preferred options for Spaniards to generate wealth.

The purchase of real estate is one of the preferred long-term investment options for Spaniards. [Read this post about Why are there still investors in bricks and mortar?]. In fact, most families live in a house they own and many also invest in another home, either to use it as a second home, to rent it out... in any case, to build equity. [Check out these tips on How to refurbish a flat for renting it out].

However, theeal estate investment, like any other, requires a certain amount of management. In recent years we have learned that house prices do not always rise. Generally speaking, it is linked to the designs of economic cycles and, of course, to those of the financial sector. But, in addition, every homeowner should be aware that there are a number of factors that specifically affect the product in which he or she has decided to invest, for example:

Excessive customisationChanges to a home should be made with the heterogeneity of the future buyer in mind, so it is advisable not to make changes that are too personal. Just because we love a certain style does not mean that others will like it!

Parking spaceNowadays, the fact that a house includes a parking space is a convenience that many people cannot renounce and they reject a possible purchase if they cannot buy a house and a parking space together in the same building.

Permanent maintenanceIt's a good idea to repair small defects as they appear in the house to prevent them from accumulating and leading to deterioration that is more costly to repair. Prevention is better than cure!

The environmentThe surrounding of a house affects its final value. This is called the "regression principle" and implies that, faced with two houses of equal characteristics and quality, one located in an area with similar housing and the other in an area with lower quality housing, the second will be sold at a lower price than the first.

The list of factors that affect the value of a home is long and the homeowner must remain aware of them in order to make decisions that protect their investment.The following factors should be taken into account: acquiring a parking space next to the house; not allowing a tenant to make overly customised renovations to the house; updating the finishes of the house gradually to prevent it from becoming outdated or even considering selling the house if changes in the neighbourhood could lead to a depreciation in the value of the house. Of all these factors, we are going to focus on one: the age of the house.

There comes a time in the life of the house when its value starts to decrease because its construction qualities are out of date with respect to new constructions.

The fact that the purchase of a particular property may be considered a good investment today does not mean that it will always be so. In other words: the curve reflecting the value of a house is not a permanent upward lineIn most cases it is a Gaussian bell representation. Regardless of the economic cycle and the crises that may occur, there comes a time in the life of the property when its value starts to decrease because its construction qualities are out of date with respect to new constructions. And what about finishes such as the type of flooring, wall finishes, sanitary ware or kitchen furniture. Even if it is only for aesthetic reasons, the passage of time makes the investment less up to date and therefore less valuable. Not to mention the more functional elements that provide an important degree of comfort to the home: The quality of the exterior carpentry and its up-to-dateness will result in the acoustic and thermal insulation of the house; the fact that the home has a heating system is important, but it is no less important that its operation is efficient and in line with current energy trends, for example.

Even There comes a time when housing is considered obsolete because it does not provide a series of comforts that have become essential requirements for any potential buyer. Moreover, the strong process of technological change in which we are immersed means that these timescales are shortening considerably. In the next few years, home automation will be widely implemented in the construction of new homes. This situation should keep many homeowners (investors, after all) on alert to consider whether it is time to make decisions: maintain the house, invest in upgrading the qualities or even consider selling before the degree of obsolescence progresses.

Buying a house is an investment that can guarantee a good future, provided that it is not just a matter of letting time go by. It is advisable to analyse the moment of the life cycle in which the real estate assets are located and to assess which decisions are the most appropriate.

At this point a logical question must be: does it make sense to sell one house to buy another? Obviously, it is not possible to generalise and each individual case may require a different way of proceeding. However, from a financial point of view, rotation is a common and advisable practice in many sectors of activity and investment products. After a certain period of time, the property is sold, profits are collected and another investment is made which, in the case of housing, is more up to date and prepared to withstand the passing of the next few years.

If, in addition, the property being sold is the primary residence, it is possible to benefit from a tax exemption if a new one, also primary, is purchased within a maximum period of two years. In this way, the law protects families who need to move house when the family grows, when they change jobs and this implies a change of city or when the children get older and they no longer need so much space. Moreover, if when selling the main residence the family is over 65 years of age, the obligation to pay taxes disappears, whether or not the gains are reinvested.

So, it can be said that whoever has a house has a treasure... If he manages it properly! Buying a house is an investment that can guarantee a good future as long as it is not just a matter of letting time go by. It is important to analyse the moment in the life cycle of the real estate asset and to assess which decisions are the most appropriate. Even good wine goes bad over time!